ValueSoft is a Billing, Inventory, and Accounting Software in India. It provides complete MIS reports, simplifies GST Return Filing, and allows easy GSTR2A and 2B Reconciliation. It's one of the best and easiest billing software for GST purposes. Demo Download is available!

Easy to Use, Simple to Learn

Using ValueSoft is extremely simple. No technical or accounting knowledge is needed. It provides many settings that you can use according to your business needs.

Saves Time and Energy

ValueSoft saves time with features like Purchase Invoice Import, GSTR1 Direct Upload, and multi-month GSTR2A/2B reconciliation.

Ready for the Future

We constantly innovate and bring the latest updates to keep the software future-ready and aligned with industry changes.

Excellent Customer Service

�A satisfied customer is the best business strategy.� We provide 100% guaranteed customer support through various channels.

Simple, transparent pricing plans that suit all your business needs!

(Limited Edition)

(Single User)

(Single User)

(Unlimited User)

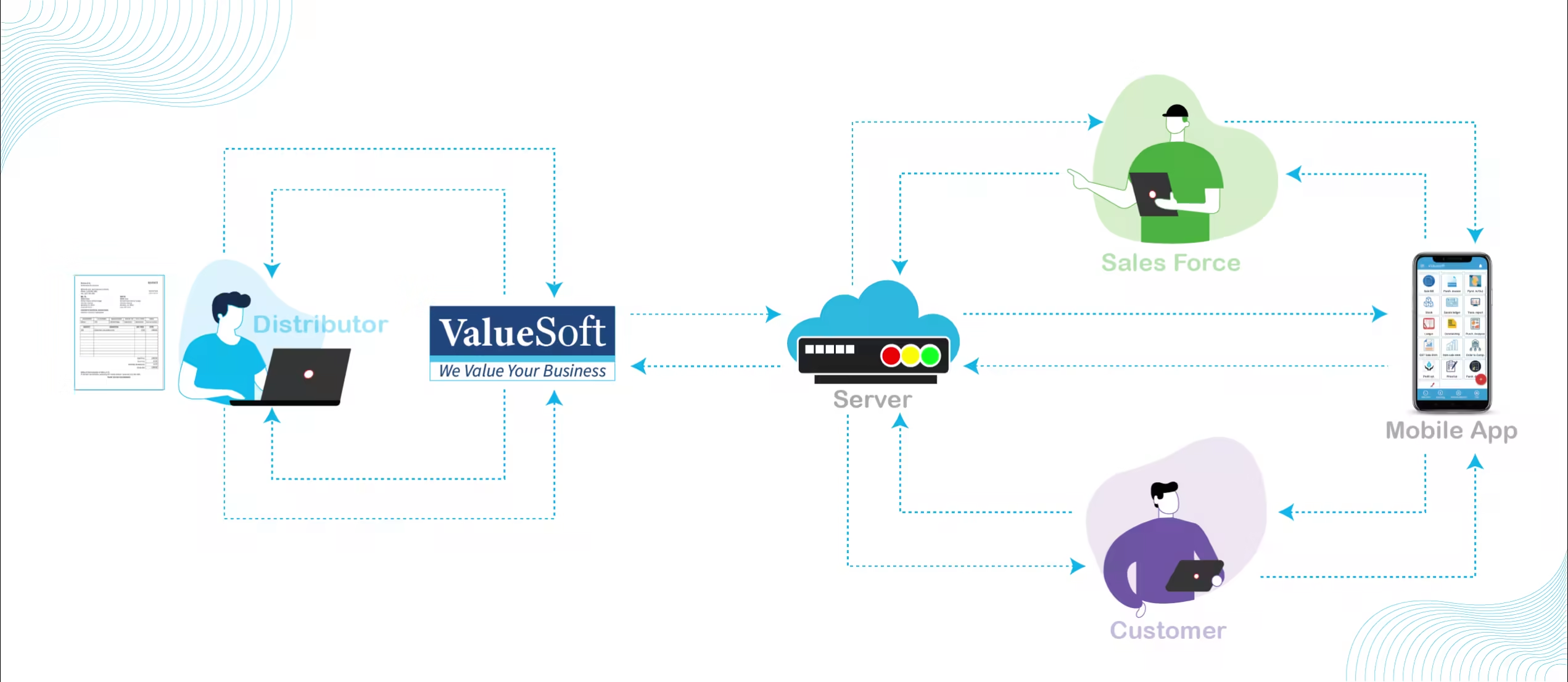

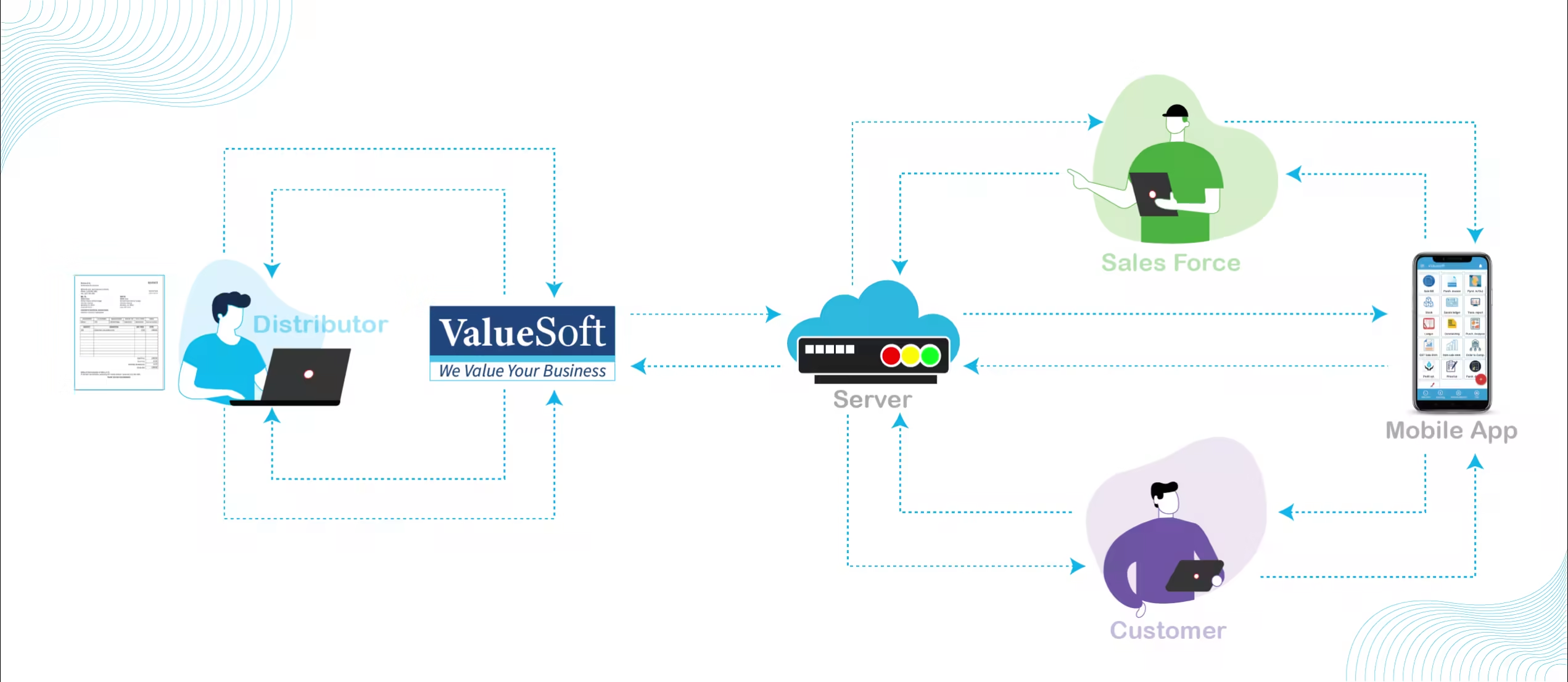

Manage your business effortlessly with our feature-rich custom app. Handle orders, returns, reports, and customer engagement all in one place.

Get a fully personalized website with your business and client data integrated seamlessly. Offer your customers a professional platform to place orders, track invoices, and manage accounts.

Save time and enhance decision-making at the point of sale with customizable solutions for different trades.

File GSTR-1 and GSTR-3B directly from the software or export to CSV/Excel/JSON for easy filing.

Access complete accounting functionality with minimal learning and easy understanding.

Track breakage, expired products, and generate credit notes efficiently.

Manage orders efficiently by converting them to bills and tracking them in real time.

Ensure data security with automatic and manual backup/restore options.

Print reports and bills on laser, dot matrix, or configure reports as per your needs.

Import and export invoices in various formats to save time and effort.

Get detailed reports for profit analysis, outstanding reports, and inactive customers.

Discover how ValueSoft is transforming businesses across industries.

Jeewan Jyoti Agencies

Kunal Medical Agency

Sureka Distributors